Customer Data Clouds are the latest industry buzz phrase for businesses that are looking to enhance customer experiences, personalize customer strategies, and improve operational efficiency.

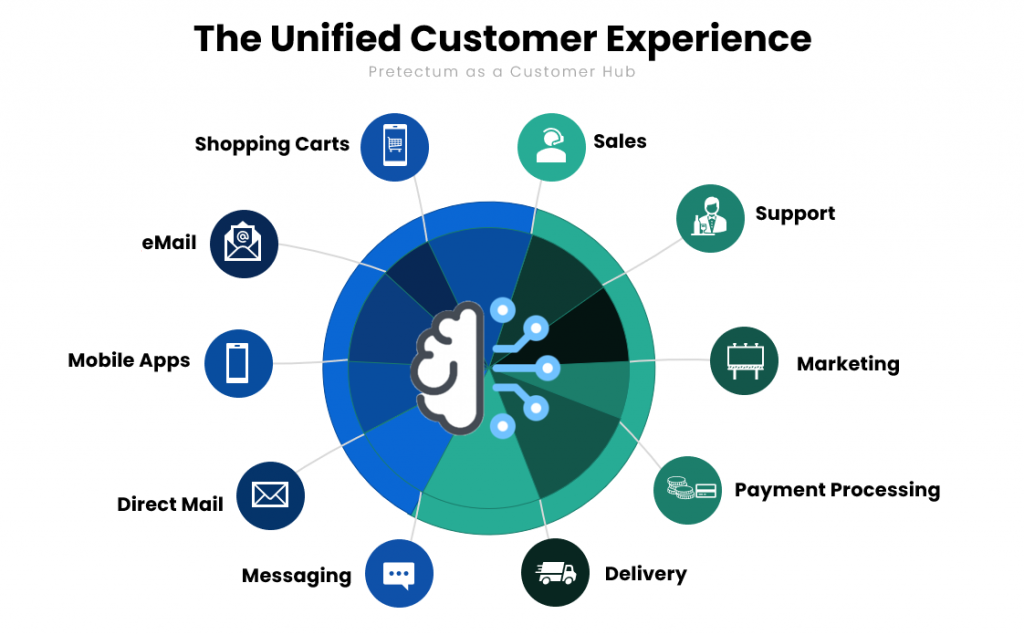

Dubbed CDCs, they are being presented as an evolution beyond mere Customer Data Platforms (CDPs). They’re offering a more comprehensive approach to data management by unifying customer information across all touchpoints, enabling advanced AI-powered analytics, and ensuring regulatory compliance. CDCs share similarities with CMDM, particularly in their goal of creating a unified customer view. However, CDCs often emphasize marketing activation and personalized experiences.

CDC are on the rise conceptually, and this is driven by increasing customer expectations for personalized service. There is also the increasing interest in how this can be AI powered and all the while meeting data privacy and data handling compliance regulations.

The move has been somewhat influenced by the shift away from reliance on third-party cookies and it is possible, that CDCs are more than just a rebranding of SaaS CDPs; they may represent a shift in enterprise data management altogether.

CDCs are presenting themselves as Comprehensive Data Ecosystems with

Advanced Capabilities, built-in governance and compliance features with a

focus on integration and zero-copy architectures.

CDCs unite customer information across all touchpoints, going beyond the marketing data integration focus of traditional CDPs, consolidating data from CRM systems, billing platforms, call center records, and digital interactions into unified, real-time profiles, again, sounds decidedly similar to the concept of the customer master data management profile.

Their advanced capabilities focus on advanced analytics, real-time data processing, and support sophisticated AI and machine learning capabilities, the specifics of which will vary from system to system and according to the particular needs of a given organization. As nextgen CDPs you should expect them to analyze customer behavior patterns and support the triggering of potential personalized experiences the instant, the customer is matched with their CDC profile.

The built-in governance and compliance frameworks they might support would have a focus on data quality and compliance by automatically identifying sensitive information, enforcing data policies, and maintaining audit trails. Again, this sounds and reads like next generation customer master data management, and a focus of CMDM in general.

Zero Copy Architecture

The idea of “Zero-Copy Architecture” is pitched as a key technological advancement. Under this design paradigm a single source of truth for data is maintained, thereby allowing multiple departments to access and analyze it without creating redundant copies. This reduces storage costs, simplifies compliance efforts, and ensures data consistency.

Though catchy, the idea of “zero-copy” perhaps hides the real situation. The objective is minimizing data redundancy, maintaining data compliance obligations, and ensuring data consistency. There can be little doubt, that an environment that allows multiple departments to access and analyze data from various source systems without creating redundant copies is advantageous but a great deal of the effectiveness of this approach relies on a unified understanding of the customer data’s purposes and intent across the various functions of an organization.

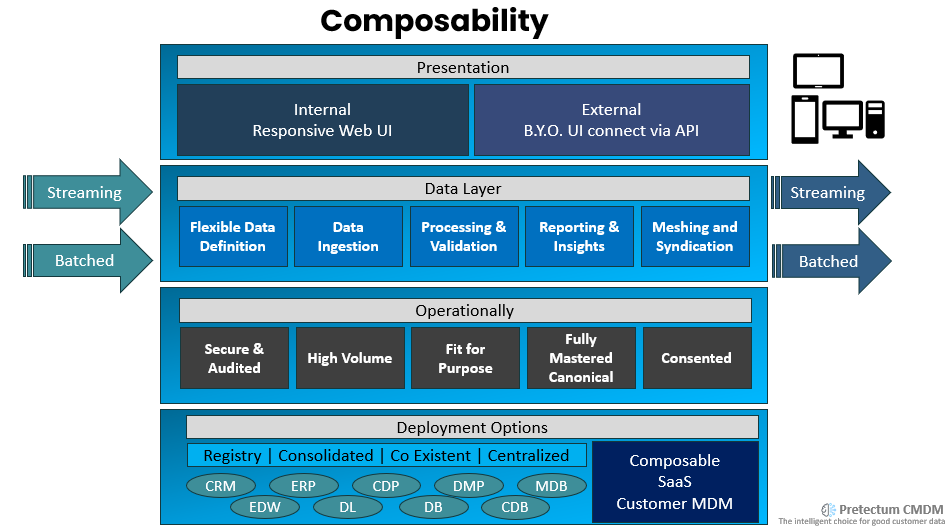

This is why the Pretectum CMDM approach aligns with the industry MDM best-practices approach; less about prescriptiveness and more about business process and procedure alignment.

Under a zero-copy architecture, you’re pursuing a Single Source of Truth, but the question is really as to where that SSOT should be. A CDC might propose a data lake, data warehouse or datastore such as one of those described in a Monte Carlo article on the topic.

The choice you would make on this might depend on a great many factors. You may have your CDP functioning like a data lake, but it could just as easily be in the Azure Cloud, a data store on Amazon S3 like Boost, Axiata Group Berhad’s award-winning homegrown e-wallet, and one of Malaysia’s largest payment platforms, or a Google Big Query datastore like TMG’s (The Telegraph) did, with all its subscription data coming from Salesforce.

Per Acquia, a clear difference between CDPs and data lakes is the types of data each platform works with. For them, a data lake ingests data in any form but is limited by its processing — basically, raw data requires time and effort to clean, maintain, and organize before it’s useful. This is in contrast to the CDP which doesn’t ingest all forms of data but is built to clean data that comes in and organize it into something manageable for a variety of teams across an organization. The skill sets to manage the two are a little different, application management (CDP) vs data engineering (Data Lake)

A Data Lake then, is a storage repository used for extensive data analysis. Scalable collection of data stored in native formats, so far from ideal for certain specific purposes. You could argue then, that if the data is further distilled before it can be used, it is hardly zero-copy – but in the end it depends on what exactly you’re doing to and with that data.

Lowered cost of ownership

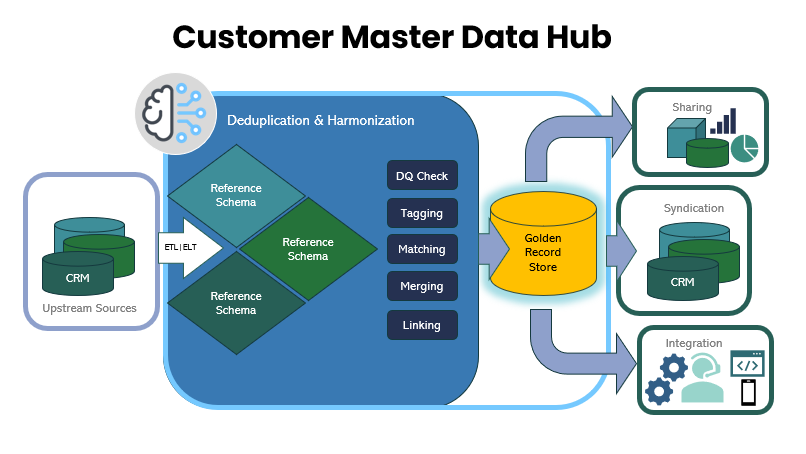

A second characteristic of these CDCs is the side effect of “zero-copy architecture” in being able to maintains a single source of truth for customer data, again, typically within that data lake store. This is something that CMDM drives anyway, through deduplication and a unified customer data profile that might use external keys to maintain the relationships between records where they reside.

Instead of copying data into separate systems or databases for different departments, zero-copy architecture enables direct access to the data where it resides . This is achieved through technologies that allow the data to be read in place. This typically means APIs or very tight integration. This may involve the use of AI, but not necessarily so. If you’re talking to a vendor that ‘tells you’ that they use AI to integrate, you’ll want to find out more about that, particularly since AIs still remain largely black-boxes, not explaining how they arrive at certain outcomes or decisions.

Additional side effects might also comes from simplification of enforcement of data policies, data access monitoring, and audit trails maintenance, all inherent characteristics of a CMDM with RBAC, data classification, masking and event auditing and logging; and all in support of compliance efforts with regulations.

One aspect of unified systems that may be overlooked, is the effort required to collate, connect to and disseminate data from distributed architectures. Here again the CDC positions itself as a time-saver for data engineers time by eliminating the need to create and manage multiple data pipelines for different departments . Instead, data engineers funnel information into the unified customer view that is kept up to date in real time. Again, exactly the same proposition of the Customer MDM solution.

Transitioning

CDCs integrate data across all enterprise touchpoints, from sales and support to IoT devices. The latter (IoT) is useful if the IoT devices can provide perspectives that sharply distinguish from other customer data. For example, on prepaid utilities, customers are often focused on three important aspects; their balance, topping up and their daily consumption. The question then, is where to draw the line between the service aspects of the data, the finance functions, the master data and the marketing.

The utility provider (Electricity, Gas, Water, Phone Services, Internet) that takes advantage of a unified data store of customer data that blends the needs of all these groups has distinct advantages over the silo that represents only one dimension of the data. On-the-fly, customers will want to see if the current outage that they are experiencing, or performance degradation is widespread or localized. They’ll want to pivot on payment methods and they’ll want to understand if there are better deals that they can get from their service provider by changing plans or going with a competitor, when an open-marketplace model is in place. Under these circumstances a CMDM and possibly a CDC could achieve what a CDP , CRM, CIC or ERP cannot, without elaborate integrations.

CMDM offers an integrated solution, as should a CDC, eliminating the need to manually stitch together multiple point solutions. Organizations should then be considering how they transition from silos like CDPs to systems that reflect the growing complexity of customer data management. Consumers expect hyper-personalized interactions across all channels, requiring B2C organizations to unify and activate customer data to drive business forward. CDPs bridge siloed systems and ensure consistency across CRM, marketing automation, and content management but there is so much more out there, which CMDM and potentially CDCs can embrace further. Successful implementation requires careful design and planning, considerations around data enrichment, and staff training.

Derek Slager, CTO and co-founder of Amperity, states, unlike traditional CDPs, CDCs “serve as comprehensive data ecosystems that unite customer information across all touchpoints while enabling advanced analytics and ensuring regulatory compliance.” These systems need to deliver “integrated identity resolution that extends beyond the enterprise’s walls” or they fall short on ROI.

First generation CDPs operate in silos that are disconnected fall short on customer activation and measurement. COmposability, where the chosen customer data profile integrates with a wider ecosystem as CMDM is intended to do, provides much greater potential for customer activation and measurement.

The Elusive Promise of AI

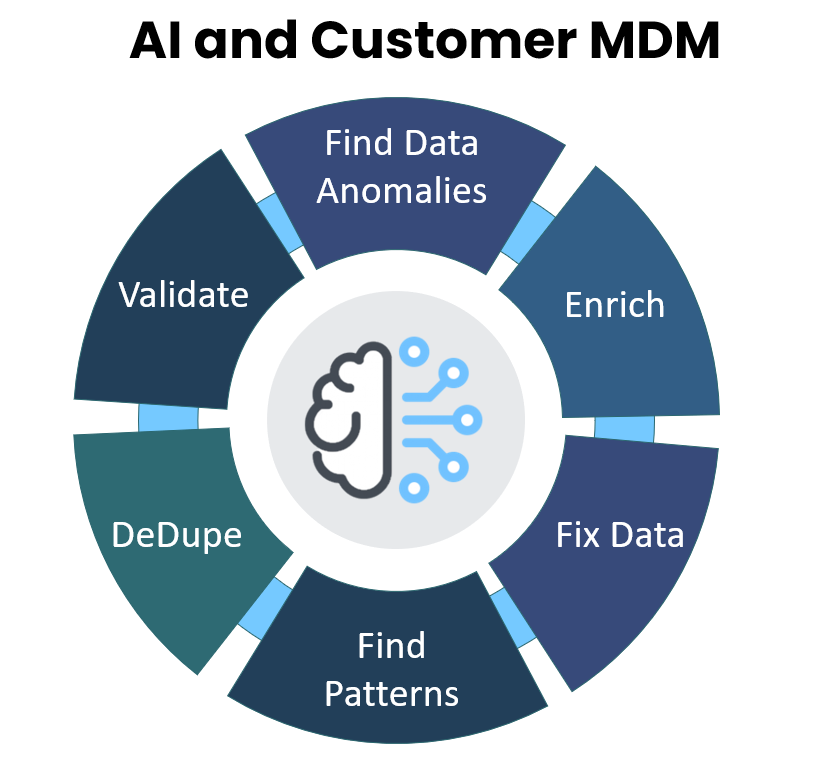

AI could play an important role in transforming customer data into actionable insights. Systems that leverage AI and machine learning to generate timely and relevant recommendations, driving personalization at scale hold a great deal of theoretical promise.

The Fast Mode a leading media brand that delivers news, analysis, and insights for the global IT/telecommunications sector points out the role of AI in Telecom: “CDCs leverage AI and machine learning to transform consolidated customer data into actionable insights, generating timely and relevant recommendations.” Models may enable the critical “final mile” of segmentation and activation, which is often under-valued when technical teams are making CDP decisions.

SAP another strong player in the telecommunications and utility sector also highlights how Customer Data Platforms like theirs might be augmented with AI to provide data-driven insights that help businesses better understand audience segmentation.

Common use cases in the telecommunications sector might not necessarily be dependent on AI as much as automation and perhaps the implementation of agent-based AI to engage with customers. identifying when customers are nearing data limits and suggesting targeted plan upgrades or bundled streaming services might not require AI but certainly AI can accelerate these types of activities with the right data inputs.

AI-powered decisioning and activation leveraging super customer data can enable customer systems to evaluate customer behavior in real-time and apply models to predict the next best action or offer.

AI-powered identity resolution offers the promise of spotting connections between customer profiles, creating a more accurate view of each customer. AI algorithms could analyze customer data to identify relationships between different profiles that may belong to the same person. Pretectum CMDM does this principally with common data traits, but this might be used to also support combining profiles in a less deterministic way.

AI-powered customer data management can forecast customer needs and behaviors by processing vast amounts of historical and real-time data, enabling proactive business strategies – this data could be from its original sources or from aggregates found in the CMDM or potentially the CDC.

AI also holds promise in helping to maintain data quality and compliance by automatically identifying sensitive information, enforcing data policies, and maintaining audit trails, something we largely do through a non prescriptive approach to customer MDM, relying instead on the customer’s own preferred methods for content curation which may already be in place.

By strategically leveraging AI within customer systems, businesses could potentially transform customer data into more actionable insights, personalize the customers’ experiences, and improve their own operational efficiency.

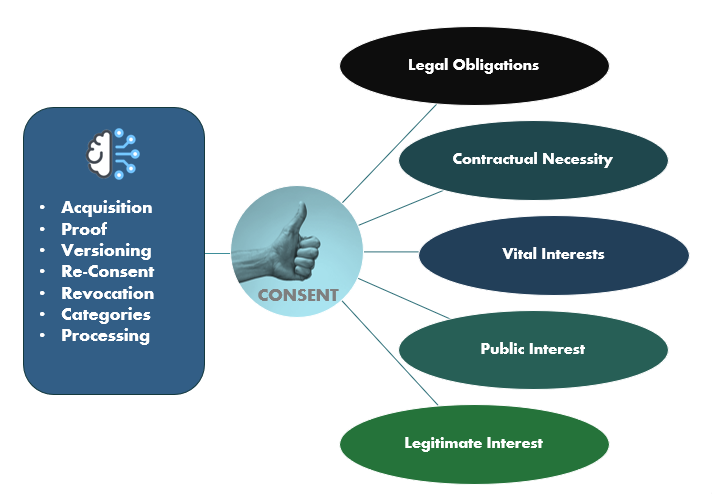

Shift from Third-Party to First-Party Data

Third-party cookie have long been used for cross-site tracking and ad targeting but they are being deprecated by the major internet browsers (e.g., Google Chrome by 2025) due to privacy regulations and increasing consumer pressure. This shift demands a focus on first-party cookies, which are collected directly from user interactions with a brand’s website or app. There are benefits for both parties, users grant explicit consent, aligning with privacy regulations, the First-party data enables tailored experiences while respecting privacy boundaries and there is reduced reliance on unstable third-party data sources.

CDPs have tried to unify customer data for activation across marketing channels and vendors have had varied success. Notably Tealium unifies profiles, provides tag management and machine learning. Amperity focuses on AI everywhere, mParticle offers Schema management, predictive analytics, and integrations (e.g., BigQuery), Treasure Data combines data unification with compliance tools and SAP CDP offers back-end data consolidation and activation, integrated with the SAP CX suite. CDCs focus on identity resolution and consent management with examples like SAP CDC specializing in front-end identity/consent management, complementing SAP CDP and Zeta Global combining identity resolution with omnichannel activation.

In contrast, the specialized solution of Pretectum CMDM emphasizes Zero/first-party data acquisition involving direct data collection with explicit consent, Governance and compliance through built-in robust frameworks for data quality and regulatory adherence, encryption, masking and auditing and enhanced security wherein breach risks are minimized through centralized, controlled data access from a single repository of consolidated customer data profiles/

CMDM vs. CDC: Key Considerations

The choice between CMDM and CDC depends on your organizational needs:

| Factor | CMDM | CDC |

|---|---|---|

| Primary Focus | Entity Resolution, data quality, governance, and compliance with consent | Data Consolidation from disparate sources. |

| Use Case | Transaction integrity, minimizing breaches | Marketing activation, personalized campaigns |

| Best For | All industries but especially regulated organizations (e.g., finance, healthcare) | B2C brands prioritizing engagement |

| Integration | Syncs with ERP, CRM, CDPs Data Lakes, warehouses, marts and legacy systems | Next generation CDP connecting to a variety of data sources including CMDM, supporting marketing tools and campaigns |

| Data Governance | Primary Focus through RBAC, federated data management, schemas, PII masking, and auditing | Secondary Focus through integration, minimized data movement, PII identification |

Customer Data Clouds may represent a significant advancement in customer data management over traditional approaches, they may empower a business to deliver more personalized and relevant experiences. By embracing CDCs and focusing on data quality, compliance, and customer-centric strategies, organizations may unlock new opportunities for growth and customer loyalty in an increasingly competitive digital landscape.

Either way, organizations adopting CMDM or CDC now will gain a competitive edge in balancing personalization with privacy in comparison with those who remain rooted in legacy approaches.

Contact us to learn how CMDM can fit into your technology stack and customer data management practice.