A Customer Master Data Management (CMDM) system can significantly enhance the efficiency and accuracy of the Accounts Receivable (AR) process, even though it does not directly handle billing or payment tracking.

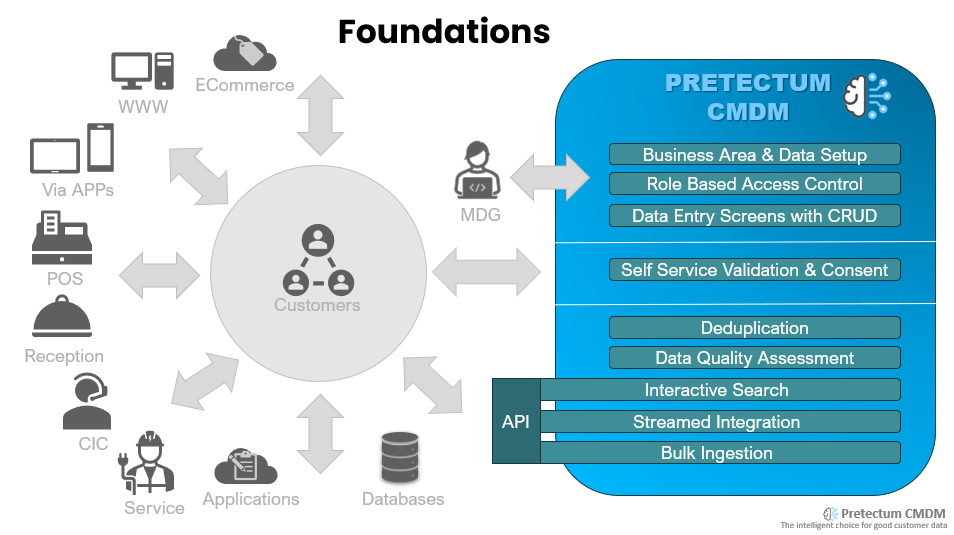

A CMDM system like the Pretectum CMDM serves as a centralized repository for customer data, ensuring that all customer information is up-to-date and accurate, which is crucial for automated collection processes.

By maintaining a single source of truth for customer profiles, the Pretectum CMDM helps prevent errors, disputes, and customer dissatisfaction that may arise from incorrect or outdated information.

Enhancing Accounts Receivable Through CMDM

The primary value of the Pretectum system in the AR process lies in its ability to support self-service account management and identity verification. By empowering customers to manage their profiles and account information independently, businesses can reduce the manual workload on AR teams. This shift allows AR professionals to focus on more critical tasks, such as prioritizing collections and managing high-risk accounts.

CMDM systems facilitate AR profile management by enabling customers to update their contact details, verify their identities, and supply necessary compliance documentation. This proactive approach to profile management minimizes the likelihood of errors and disputes, as customers take ownership of their data. By reducing the need for manual updates by AR teams, businesses can increase the time available for collections activities, ultimately improving cash flow.

Integration with Payment Portals

CMDM systems can be instrumental in the automation of the process of sending reminders to customers to verify and update their profiles. This type of automation ensures that customer information remains current without requiring constant manual intervention. By tracking the status of unverified profiles, AR teams can focus their efforts on collections rather than administrative tasks, further enhancing efficiency.

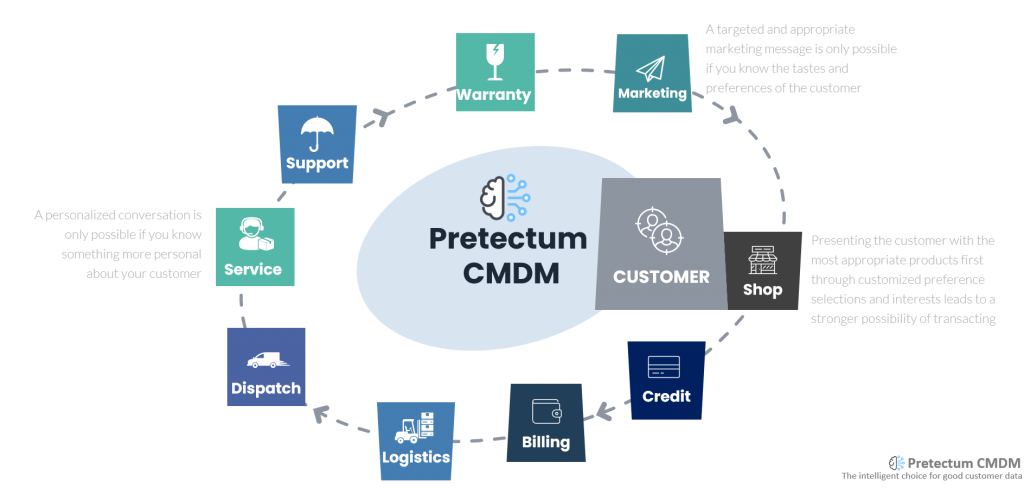

While Pretectum CMDM does not manage billing directly, it can play a crucial role in integrating with your payment portals and systems. By providing a harmonized and unified view of customer data, CMDM systems ensure that all parties involved in the payment process have access to accurate and consistent information. This integration reduces the risk of errors during transactions and enhances the overall customer experience.

Pretectum CMDM act as the central hub for customer data, which can be accessed by various departments, including AR teams. This centralized approach ensures that all customer interactions are based on the most current information, reducing the likelihood of discrepancies and disputes.

The system can maintain a library of reference points for tax and audit, which can be readily accessed during audits. This is particularly important for ensuring customers only have one account as a reference point. This capability reduces the time and effort required to gather information from customers, have confidence in correct customer billing and allow AR teams to focus on collections and improving cash flow.

Addressing Credit Account Duplications

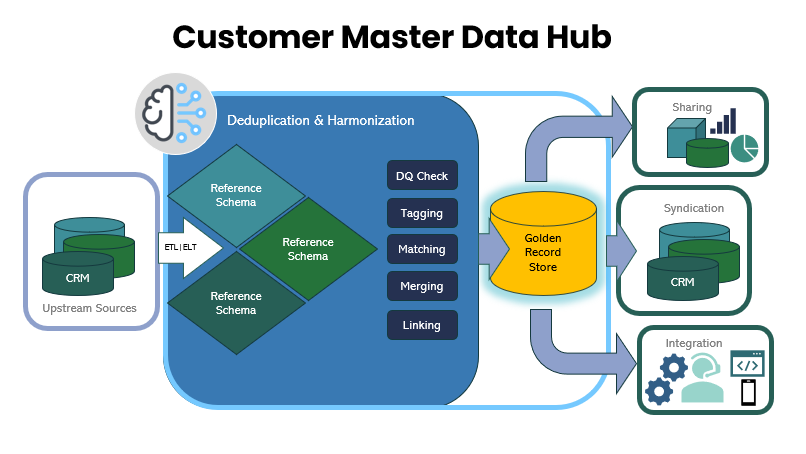

One of the primary benefits of implementing a CMDM system is its ability to identify and consolidate duplicate customer records.

In many organizations, customer data is scattered across various systems, leading to inconsistencies and duplications. This fragmentation can result in customers having multiple credit accounts, which complicates the management of credit limits and exposes the business to unnecessary risk.

Pretectum can serve as a centralized repository for customer data, ensuring that all records are standardized and de-duplicated. By consolidating customer information from disparate systems into a single master record, Pretectum eliminates the confusion and potential errors associated with duplicate accounts. This consolidation allows businesses to manage credit more effectively, ensuring that each customer is accurately represented and their credit exposure is correctly assessed.

Mitigating Risks of Customer Debt Across Multiple Accounts

Having customer debt spread across multiple accounts can pose significant risks to a business. It can lead to inaccurate credit assessments, increased likelihood of credit limit breaches, and difficulties in tracking and collecting outstanding debts.

The Pretectum CMDM helps mitigate these risks by providing a unified view of each customer profile. By maintaining a single source of truth for the customer, the system enables businesses to have a comprehensive understanding of the customer and more appropriately manage the exposure. This holistic view is crucial for making informed credit decisions and managing risk effectively. For instance, if a customer attempts to open a new line of credit while already having outstanding debts in another division, the CMDM system can highlight the fact that the record exists already, preventing the proliferation of accounts.

Supporting Compliance and Audit Requirements

Pretectum CMDM also enhances operational efficiency by streamlining data management processes. By reducing the need for manual data entry and reconciliation, Pretectum frees up valuable resources that can be redirected towards more strategic activities, such as credit analysis and collections. This efficiency is particularly important in large organizations where customer account data duplication can choke IT resources and consume data quality budgets. This centralized function also facilitates better communication and collaboration across departments by ensuring that all teams have access to the same, accurate customer data. This consistency reduces the likelihood of errors and disputes, improving the overall customer experience and fostering stronger customer relationships.

In addition to improving data accuracy and operational efficiency, CMDM systems support compliance and audit requirements by maintaining a comprehensive audit trail of customer data changes. This capability is essential for businesses operating in regulated industries, where data integrity and transparency are paramount. By providing a clear record of all customer data interactions, CMDM systems help businesses demonstrate compliance with regulatory standards and reduce the risk of penalties or legal issues. This transparency also builds trust with customers, who can be confident that their data is being managed responsibly and securely.

Empowering AR Teams with Automation

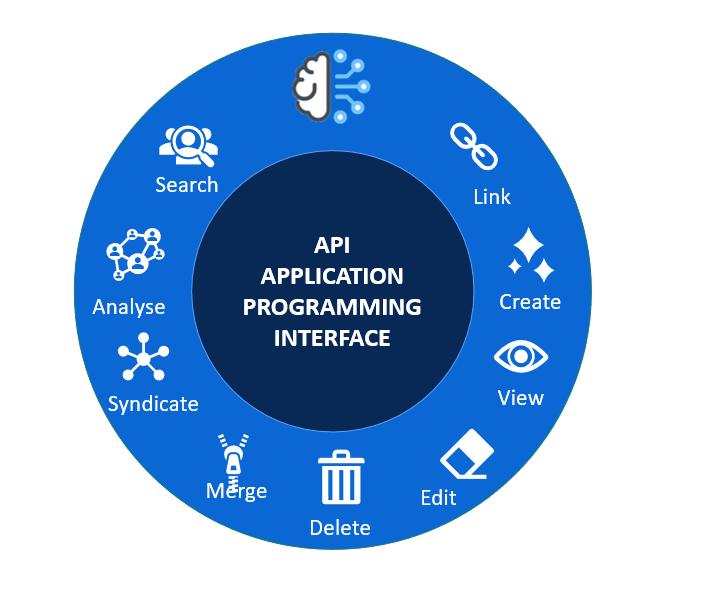

Automation is a key component of modern AR processes, and CMDM systems play a vital role in enabling this automation. By providing accurate and up-to-date customer data, CMDM systems support automated communications, collections activity management, and reporting.

Integration of the Pretectum CMDM system supports the automation of improved reminders and notifications, ensuring more timely communication with customers. Such automation reduces the manual workload on AR teams and can drive improvements in the consistency and professionalism of customer interactions.

By integrating with AR systems, Pretectum CMDM provides AR teams with additional tools that can improve collections activities more effectively. This integration allows for the prioritization of collections efforts based on customer risk profiles and payment behaviors, improving the efficiency of the collections process.

Pretectum CMDM supports the generation of reports and analysis, providing AR teams with insights into customer profiles, gradings, and customer segmentation. This information is crucial for making informed decisions and optimizing finance strategies.

While Pretectum CMDM does not directly manage billing or payments, it adds significant value to the accounts receivable process by ensuring the accuracy and consistency of customer data.

By empowering customers to manage their profiles independently and supporting integration with payment portals, CMDM systems enhance the efficiency and effectiveness of AR operations.

Automation of communications and ancillary consent and verification activities further streamline the process, allowing AR teams to focus on high-priority tasks and improving overall cash flow.

As your business continues to seek ways to optimize its AR processes, Pretectum CMDM will present itself as a valuable tool for achieving operational excellence and improving customer satisfaction. Contact us to learn more.