To run a customer marketing campaign or undertake any customer analytics, you might consider a variety of customer-related data at your disposal.

There are several types of customer data that you might consider but what we will focus on here is how you can consider the incorporation of aggregates into your customer master to help influence and inform your decisions and actions as a business.

Transactions

Transactions are easily understood. They occur every time there is a value exchange between your business and the customers. Every additional transaction deepens the relationship that your business has with the customer and likely also influences if they will be a customer again. While you may have a particular interest in the tastes and preferences of the customer. At the aggregate level, it is useful to know how many times the customer has transacted with you, the average value of each interaction and the frequency between transactions. By having these attributes tied to the individual customer master you can calculate the lifetime value of that customer, perhaps infer something about their preferences and how they might respond to certain events or promotions. Your CDP or eCommerce platform may have this information but would this be of value to other areas of your business?

Service and Support

If you sell products that are often associated with a service element then, this is an aspect that can likely also be easily understood.

Every time the customer engages with a representative of your organization around a service or support element associated with the goods and services you provide can inform your business about the levels of the relationship that exists between the customer and your business and its goods and services.

Some sort of survey assessment at the conclusion of every interaction can also tell you whether this customer is a net promoter or detractor of your business. This information could be useful in your next engagement or outreach event associated with that customer. Insight into contacts can help to convey a closer understanding and form a stronger bond between your business and the customer. Consider how you could incorporate survey, support ticket, warranty and other aggregated information into the customer master

Social media

Your CDP platform likely contains some understanding of the social media aspects of your customers but it is likely that there is nothing on the CRM or ERP system. If you collect social media data you may be able to see which platform is the most popular among your customer base. You could consider this in influencing your marketing campaigns and also decide what type of social media platforms and posts perform best and what time of day. Using social media information can influence what you create and publish for maximum reach. Social media is a critical avenue for certain types of brands, and is now less of an area of exploration and testing, and more a necessary line item within the marketing plans for brands.

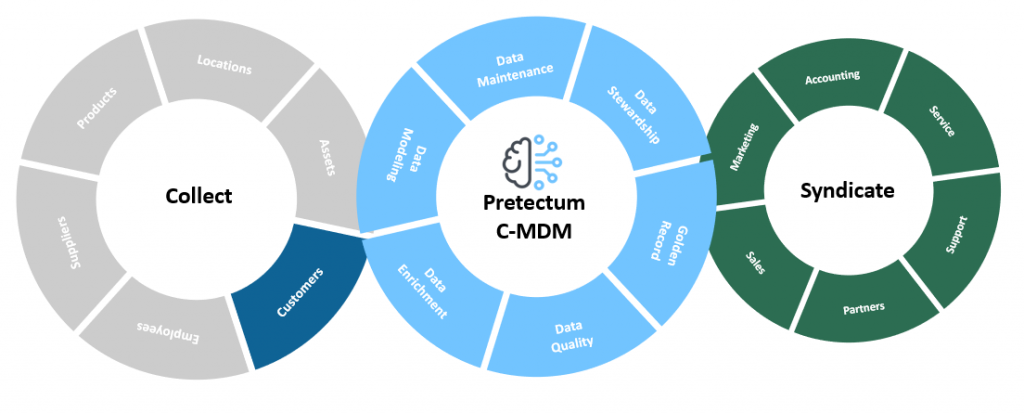

The Pretectum CMDM can be configured by you to take the aggregations from these other sources and incorporate them into your Customer master ready for syndication to whoever needs the data.

Learn how the Pretectum CMDM can help you as a single domain MDM software solution designed specifically to address the challenges of Customer Master Data Management.