The insurance industry, like many others, is evolving in an unexpected way riding on the back of the positively vast potential of its portfolio and policy data and leveraging the power of machine learning and artificial intelligence (AI).

Deep in the heart of this (r)evolution is something that insurers need to understand to make their business better and transform their operations. All the while, they can enhance client relationships, and drive greater profitability.

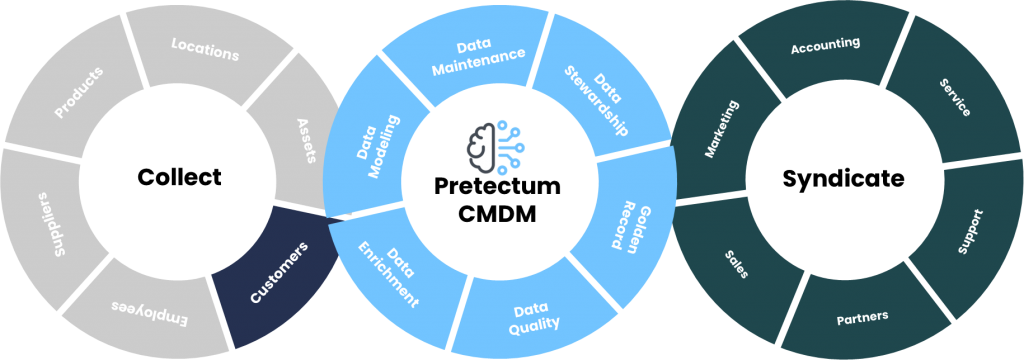

Riding on the coattails of several articles by leading minds in the industry, we thought that here at Pretectum, we might add our views on this topic with a Customer Master Data Management (CMDM) slant.

A Framework for Insurance Industry Success

Know what’s happening: The first step in leveraging customer master data, and, in fact, any kind of data, is to understand what has happened and is currently unfolding within your business. This goes for any business, but in the insurance business, this is somewhat nuanced. When you look at past and current data, you can glean operational insights, such as brokerage and policy management staff productivity, brokerage and policy sales momentum, product line and account profitability, and carrier relations.

Such knowledge transforms the reams of transactional data into potentially actionable insights, particularly when evaluated with a big-data lensed sift, sort, and aggregate mindset. By knowing what’s happening transactionally, you can enable your agencies to move from being mere data gatherers to instead becoming trusted advisors for clients.

Make big-data-driven recommendations: Once you’re armed with insights about the business, you can transition into the recommended action phase. Here you can explore how data can be used to predict behaviors and outcomes. This phase opens the door to loads of opportunities, particularly in renewals and retention, account rounding and upselling, and understanding customer sentiment in general.

Renewals and Retention: Data-driven recommendations can identify accounts at risk of not renewing, this allows agencies to provide extra care and attention where needed. The AI/ML algorithms analyze factors such as renewal price increases, reasons for the increase, and overall client value, categorizing renewals as high or low risk.

Account Rounding and Upselling: By understanding clients’ needs and aligning them with their current policies, data recommendations enable agencies to offer valuable advice on coverage and policy options. Algorithms dig through the data, suggesting missing policies or underinsured coverages, empowering agents to enhance client value while increasing profitability.

Customer Sentiment: When you leverage AI, you can gauge client satisfaction by analyzing past interactions. This includes email responses, social media activity, billing, claims, and service requests. The result is a simple yet powerful sentiment score (0-100), guiding agents on where to focus extra effort and become trusted advisors to clients at the right time.

Get assistance From AI: Moving on to an assist phase reveals the intersection of data and AI-driven automation. AI has the potential to augment agency efforts, assisting agents in completing tasks more efficiently and accurately. “Connected Intelligence” workflows, fueled by data and AI, optimize agent time, providing relevant insights, automating routine tasks, and allowing agents to concentrate on high-value work.

Expect to see growth in integrated generative AI tools in things like word processors and email and hopefully in your agency platform, which can significantly aid agents in crafting concise and engaging communications in a fraction of the time it would take manually. If you love spell check and grammar check, well, just wait for generative AI recommendations for communications! This not only helps agents capture the attention of clients but also frees up valuable time for more strategic endeavors. The higher value work of growing the customer portfolio.

Embracing the Future: Overcoming Challenges

While the promise of data and AI is immense, challenges may deter agencies from embracing this transformative journey fully. You need to find the right tools and the right data, the data needs to be reliable, and trusted, and making it work for the business is crucial especially since you won’t want to engage with customers using data in creepy intrusive ways.

Finding the Right Data: Identifying relevant data sources is the initial hurdle. Agencies need to work out which data points are crucial for their operations and align with their business objectives. This involves a thorough assessment of all potential internal data, looking at market trends, and examining client interactions to create a comprehensive data foundation. We see the Customer Master as a key data component in all this.

Ensuring Trustworthiness: The integrity of the customer master and transactional data is paramount. Establishing robust data governance practices ensures that the information used for decision-making is accurate and reliable. This involves implementing data quality checks, validation processes, and regular data audits to maintain the credibility of the data.

Making Data Work for the Business: Turning data into actionable insights requires a strategic approach. Agencies should invest in technologies and platforms that facilitate easy data interpretation. Collaborating with AI solutions that integrate seamlessly with existing management systems empowers agencies to derive value from data without overwhelming complexities. Here, you can use any number of cloud solutions but you should probably look at tokenized identifiers for the customer and cross reference those back to the CMDM to maintain privacy and minimize the risk of data loss.

A Vision for Tomorrow: The Road Ahead

Your agency needs to deal with a highly dynamic landscape of data and AI, and needs a vision for tomorrow that starts today! Successful integration of such technologies not only streamlines operations but also positions insurers as forward-thinking industry leaders.

Transforming insurance from stodgy conservative and traditional data handling practices to more sophisticated, AI-driven approaches is a journey of (r)evolution, and one that promises unprecedented growth, enhanced client relationships, and the establishment of a competitive edge in the market.

Your customers’ data and AI in insurance, represent an exciting frontier of possibilities.

Look to this framework where you “know what’s happening”, “make data-driven recommendations”, and get assistance from AI! Insurance agencies can unlock a new potential and be at the forefront of modern data-driven innovations, paving the way for a future where data and AI are not just tools for “the rest” but tools for the “The Best”!

Reach out to us to learn how the Pretectum CMDM can be helpful in your AI, ML, and LLM-based customer data initiatives.