The Pretectum Customer Master Data Management (CMDM) platform offers distinct advantages in the banking sector compared to more generic data management platforms (DMPs), customer relationship management (CRM) systems, customer data platforms (CDPs), generic Master Data Management (MDM and traditional banking systems.

Consider the relevance of these to your organization.

Key Features of Pretectum CMDM

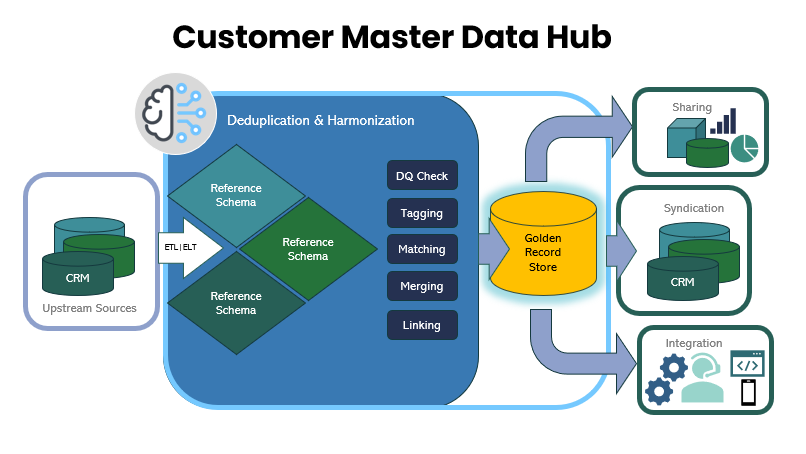

Golden Record Management: Pretectum CMDM focuses on creating and maintaining a “golden record” for customer data, ensuring a single, accurate view of each customer across the organization. This is particularly valuable in banking, where accurate customer data is critical for compliance and personalized service.

Data Hub Functionality: Pretectum acts as a central data hub, integrating seamlessly with peripheral systems. This supports various data integration and syndication modalities, which is essential for banks that need to aggregate data from multiple sources.

Data Quality and Security: The platform includes robust data quality management features, lightweight ETL processes, and data preparation tools. It also offers encryption and data security measures, ensuring compliance with regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering).

Self-Service and Consent Management: Customers can verify and manage their contact data and consent preferences, enhancing transparency and trust. This self-service capability is increasingly important in the digital banking environment.

Scalability and Configurability: The CMDM is highly configurable and supports horizontal scaling, allowing banks to adapt to changing data volumes and business needs without compromising performance.

Comparison with Other Platforms

- CRM Systems: While CRMs focus on managing customer interactions and sales activities, they often struggle with data fragmentation and do not provide a unified view of customer data. The CMDM addresses these limitations by ensuring data consistency and accuracy across all customer touchpoints.

- CDPs: CDPs are designed for marketing purposes, unifying customer data from various sources to create comprehensive profiles for personalized engagement. However, they may not provide the same level of data governance and accuracy as CMDM, which is crucial for banking operations.

- DMPs: DMPs are primarily used for advertising and focus on managing anonymous audience data. They do not offer the detailed customer profiling and data accuracy needed for banking compliance and customer service.

- Traditional Banking Systems: These systems often lack the flexibility and modern data management capabilities of CMDM, such as full auditable customer master data processing and comprehensive master data governance, which are essential for meeting current regulatory and customer expectations.

The Pretectum CMDM platform provides a specialized solution for managing customer data in the banking sector, prioritizing data accuracy, security, and integration capabilities, which are less emphasized in other platforms.

Contact us to learn more