We use customer analytics to collect and analyze customer data to learn about customer behaviour and preferences. We use that analysis to inform our strategic and tactical decisions and to assist with the formulation of customer-centric recommendations.

This analysis is undertaken to provide answers to many kinds of customer-related questions and can embrace different types of business analytics.

Businesses may employ descriptive analytics to describe the current state of the customer. Diagnostic analytics describes the root cause of a particular customer or business problem.

Using machine learning, artificial intelligence and data science can provide predictive and prescriptive analytics that can be used to suggest the next best action or remediation steps to take to solve particular customer-related challenges, they can also help with forecasting and predicting behaviour.

On face value almost all and any of these approaches to analysing the customer could be used. To be effective however, you need to have the best possible data and the most complete attributes for a customer record.

In breaking down the attributes of the customer it is valuable to know much more than just the customer name, email and address although, these in themselves can suggest a great deal about the customer on their own.

The power of AI, ML and data science can suggest some key attributes related to the customer but what is most valuable is the ability for the customer to offer up this information themselves, voluntarily and as comprehensively as they feel comfortable.

We’re almost all probably familiar with the model that has been used by the financial services industry over the years to assess and assure credit worthiness and reduce risk, many of these data attributes are voluntarily offered up by customers depending on their level of confidence in your business and in particular their confidence in your judicious use of the data in the execution of business sales and marketing activities.

If you ignore the transactional aspects of how you interact with the customer and focus all your energy on the customer master itself, you may in fact find that there is enough there to make some educated inferences for the many purposes of your diverse business needs. If you choose to append aggregated transactional data that can also be useful but like all things, this needs to be refreshed regularly in order to prove most valuable.

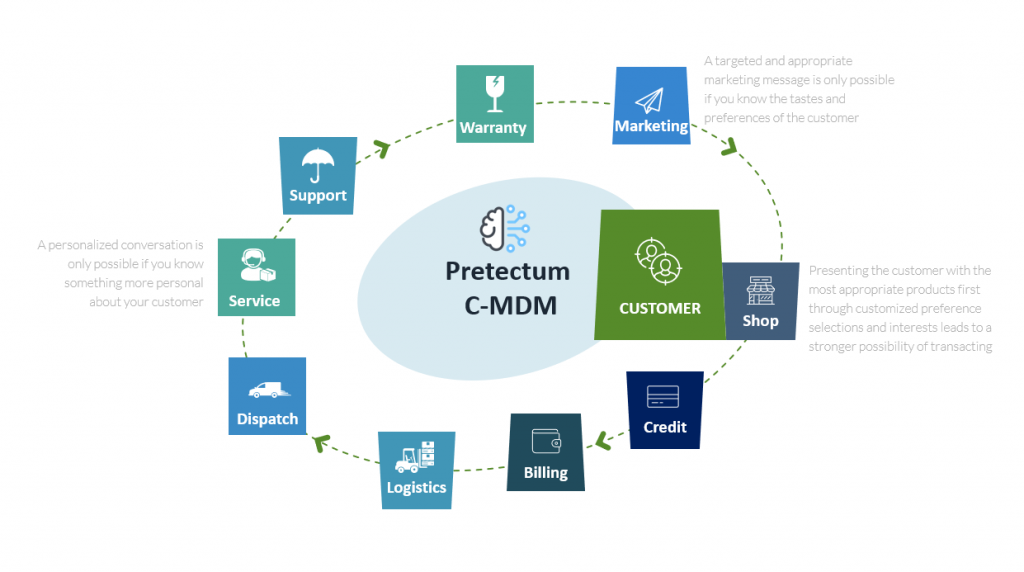

So where does the Pretectum CMDM platform fit into the vision for an elegant and useful deconstruction of the customer master?

The first element to consider is security. Every tenant of the Pretectum CMDM operates in their own compartmentalized client of the platform.

Secondly, even within the domain that you have, you have your data and users segregated by business area. This means that the Accounting team can operate completely separately from the marking team but they also have the potential to use the same data that perhaps comes from the customer account management team.

You can determine exactly what data you want to hold in the Pretectum CMDM store. All the data you store can also be augmented with either self-service data from your actual customers as well as data that comes from trusted data providers. All the data is stored in a secure and encrypted way that is visible and accessible to only those teams and individuals that you grant explicit access.

Learn how the Pretectum CMDM can help you as a single domain MDM software solution designed specifically to address the challenges of Customer Master Data Management.