Effective data management is a fundamental pillar of success for any organization, especially within the finance and accounting fields.

Accuracy and reliability of data are important because they directly influence decision-making, meeting regulatory compliance obligations and addressing overall operational efficiency.

Rapid advancements in technology and the increasing complexity of financial transactions, accompanied by the sheer volume of data generated daily is staggering. These volumes of data necessitate robust management strategies to ensure that organizations can harness this information effectively.

High-quality data enables organizations to make informed decisions, mitigating risks and enhancing strategic planning. The regulations are stringent and compliance is non-negotiable, so, having a solid data management framework is essential to avoid costly penalties and reputational damage.

Streamlined data management processes also lead to improved operational efficiency, reduce the likelihood of errors and enable teams to focus on higher-value tasks. Nobody wants to work for an organization that is mired in unnecessarily labour intensive back office functions; so attracting and retaining talent is closely tied to the kinds of systems and practices that you have in the back office.

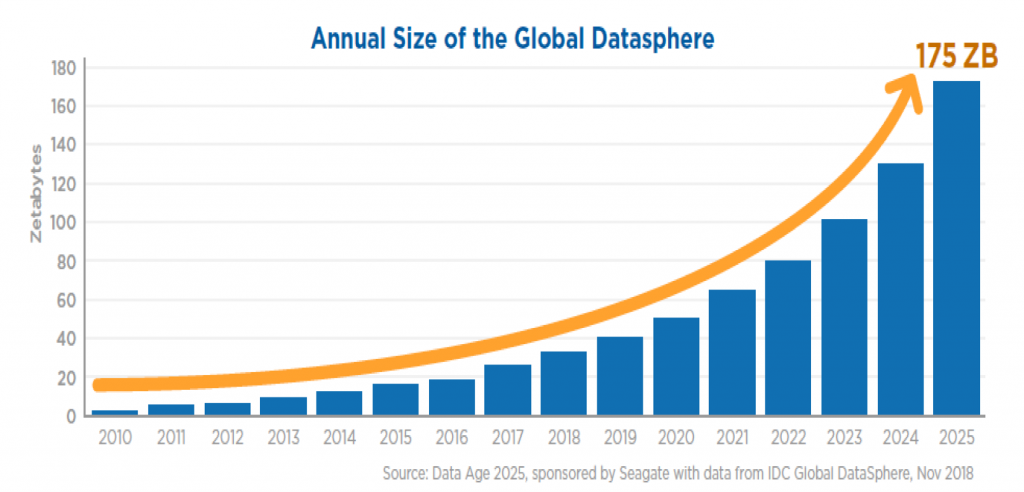

The “global datasphere” continues to expand—projected to grow from 33 zettabytes in 2018 to 175 zettabytes by 2025—organizations face an urgent need to adopt effective data management strategies.

Datasphere growth presents both challenges and opportunities. On the one hand, the sheer volume of data can overwhelm systems and processes; on the other, it offers a wealth of insights that can drive innovation and competitive advantage.

To navigate this landscape successfully, organizations must prioritize key components of data management, including governance, security, integration, quality management, and analytics.

Data governance establishes the framework for how data is managed, ensuring that policies and procedures are in place to maintain data integrity and compliance. Security measures are crucial for protecting sensitive financial information from breaches and unauthorized access.

Additionally, integrating data across various systems ensures that information flows seamlessly, providing a holistic view of the organization’s financial health. Maintaining data quality is vital to ensure accuracy and consistency, while advanced analytics tools can unlock valuable insights, driving better decision-making and strategic initiatives.

The Impact of Poor Data Management

Data management plays a pivotal role in driving insightful decisions and ensuring the financial success of a company. With accurate and timely data, finance professionals can make informed decisions, mitigate risks, and identify opportunities for growth. However, navigating this landscape is not withouts its challenges, with issues like data inaccuracies, security breaches, and complex integrations often standing in the way.

Poor data management can have far-reaching consequences for financial organizations. Inaccurate data leads to bad financial decisions, negatively impacts bottom lines and damages reputations. Stakeholders may lose confidence not only in the finance team’s capabilities but in the company as a whole.

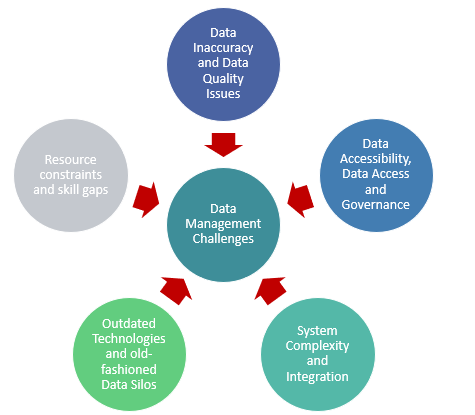

Common Data Management Challenges

Data Inaccuracy and Data Quality Issues

One of the most prevalent challenges in financial data management is ensuring data accuracy and quality. Human errors, system glitches, and the sheer volume of data being handled can all contribute to this problem.

Data Accessibility, Data Access and Governance

Data management challenges related to accessibility, access, and governance are multifaceted and interconnected. Organizations often struggle with breaking down data silos, managing the ever-increasing volume and complexity of data, and implementing effective role-based access controls.

These issues are compounded by the need to maintain data quality, ensure regulatory compliance, and foster data literacy among employees. The lack of standardization across systems and unclear data ownership further exacerbate these challenges.

To overcome these hurdles, companies must adopt comprehensive data governance frameworks, invest in modern data management technologies, and prioritize data integration and discovery initiatives.

By addressing these challenges holistically, organizations can create a more accessible, secure, and valuable data ecosystem that drives informed decision-making and innovation while maintaining compliance with evolving regulatory requirements.

System Complexity and Integration

As systems become more complex, with numerous interconnected parts and diverse technologies, the challenges of integration multiply. Complex systems often exhibit non-linear behaviors and emergent properties that are difficult to predict, making integration a formidable task.

Key challenges include managing interfaces between components, dealing with unexpected behaviors, and ensuring scalability of integration approaches. To address these issues, strategies such as modular design, incremental integration, and advanced simulation techniques are often employed.

.Systems thinking is crucial, emphasizing a holistic view and recognition of interdependencies.Adaptability is also vital, with flexible architectures and continuous integration practices helping to manage evolving complexity.

Outdated Technologies and old fashioned Data Silos

Data fragmentation across disparate systems, makes it difficult to obtain a unified view of information. This leads to inconsistent data, reduced data quality, and inefficient decision-making processes.

Limited scalability of legacy systems, which struggle to handle increasing data volumes and diverse data types results in performance issues and hinders the organization’s ability to leverage big data analytics. Poor data integration capabilities, making it challenging to combine data from various sources for comprehensive analysis.

All of this impedes the creation of valuable business insights.Inadequate security measures in older systems, increasing vulnerability to data breaches and compliance risks. A lack of real-time data access, as outdated technologies often rely on batch processing, delaying critical information updates.

Further, difficulties may exist in implementing modern data governance practices due to inflexible legacy architectures. These challenges collectively hamper an organization’s agility, data-driven decision-making capabilities, and overall competitiveness in today’s fast-paced business environment.

Resource constraints and skill gaps

Finance teams often struggle with limited resources and skill gaps that impede their ability to harness the full potential of data. These constraints manifest in several ways, such as there being insufficient staffing to handle increasing data volumes and complexity.

There may also be a lack of expertise in advanced analytics, machine learning, and data visualization accompanied by inadequate training in modern data management tools and techniques.

Hard pressed and limited budget for investing in up-to-date data infrastructure and software are often also a challenge, and these limitations result in underutilization of advanced analytics capabilities, compromised data quality due to manual processes and lack of proper data governance and an increased risk of non-compliance with evolving regulatory requirements accompanied by an inability to provide real-time insights for strategic decision-making.

To address such challenges, organizations need to prioritize upskilling their finance teams, invest in user-friendly data tools, and consider partnerships with data specialists. Adopting cloud-based solutions lik the Pretectum CMDM can help alleviate some resource constraints while providing access to better data quality and data access in secure and reliably performant ways.

Solutions for Effective Data Management in Finance

Implementing Data Validation Processes

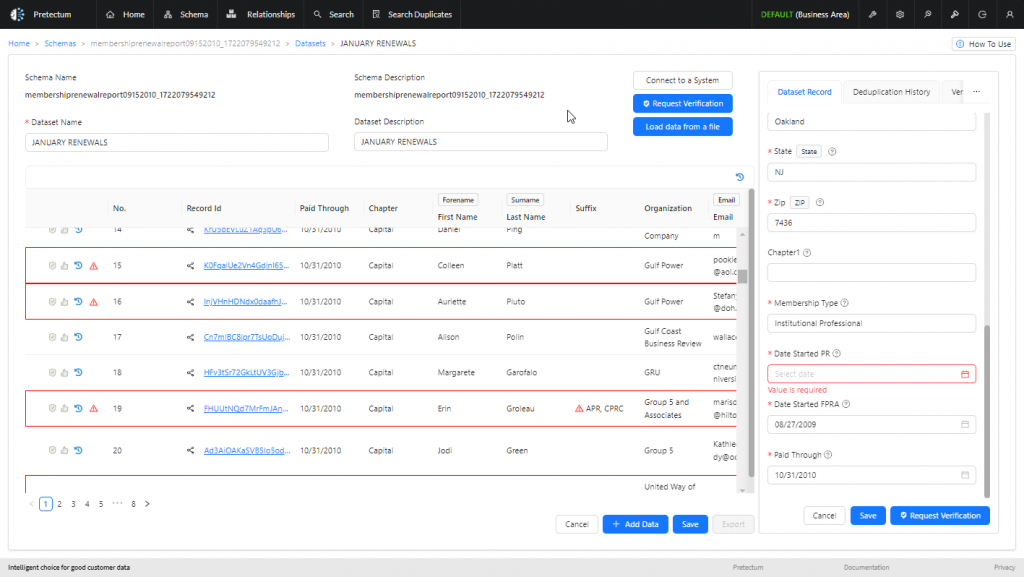

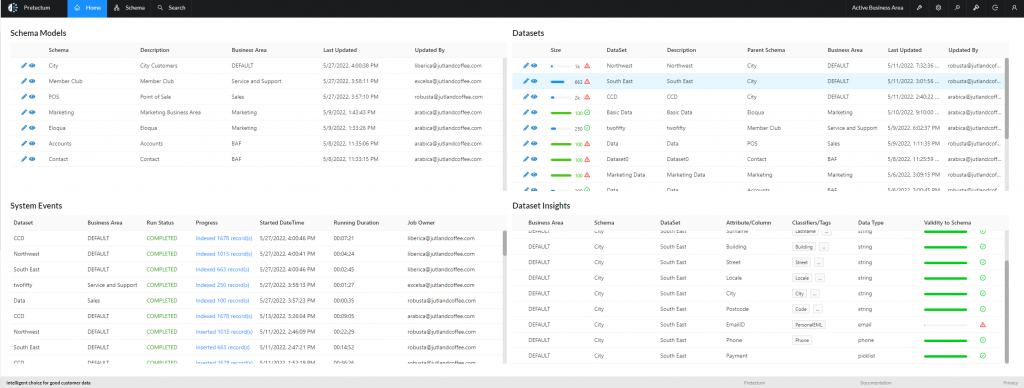

Pretectum’s Centralized Master Data Management (CMDM) plays a vital role in tackling data inaccuracy and quality issues that many organizations face. One of the most effective strategies is to implement data validation processes right at the point of entry. By centralizing master data, Pretectum ensures that there is a single source of truth for critical business information, which is essential for maintaining data integrity.

Automated error checks can significantly enhance data quality by flagging inconsistencies as they occur. This real-time monitoring allows organizations to address issues immediately, preventing them from snowballing into larger problems down the line. Additionally, regular audits are crucial in identifying and rectifying discrepancies before they become pervasive. Pretectum’s CMDM provides the tools needed to establish standardized data formats and structures, making it easier to maintain consistency across the organization.

With features like data governance workflows and audit trails for data changes, organizations can ensure proper data stewardship. By leveraging these capabilities, businesses can proactively manage data quality, reduce the burden of manual error-checking, and ultimately support more reliable analytics and informed decision-making. This comprehensive approach not only enhances data accuracy but also fosters a culture of data accountability within the organization.

Enhancing Data Access with Control and Governance

Pretectum CMDM addresses the challenges of enhancing data accessibility and governance through a comprehensive approach that aligns with best practices in data management. The platform centralizes customer data storage, creating a single source of truth that breaks down data silos and facilitates seamless access across departments. This centralization not only improves data consistency but also streamlines integration processes, making it easier for various teams to access and utilize customer information.

To balance accessibility with security, Pretectum CMDM implements robust role-based access controls. These ensure that employees can access only the data necessary for their roles, maintaining data security while enabling efficient work processes. The system’s advanced security features, including encryption and authentication protocols, safeguard sensitive customer information from unauthorized access.

The platform supports the establishment of clear data governance frameworks by providing tools for defining and enforcing data quality standards, data stewardship roles, and access policies. This structured approach to governance ensures that data is handled responsibly and in compliance with regulatory requirements.

The user-friendly interface and data visualization capabilities make complex data more accessible to non-technical users, addressing the challenge of overwhelming raw data. By presenting information in easily digestible formats, Pretectum CMDM empowers employees across the organization to derive insights and make data-driven decisions.

Furthermore, Pretectum CMDM facilitates ongoing data quality management through automated validation processes and regular audits. This proactive approach to maintaining data accuracy and consistency enhances the overall reliability and usability of customer data.

Modernizing Technology Infrastructure

Pretectum CMDM is built from the ground up to run on cloud infrastructure, leveraging modern technologies. This cloud-native architecture provides superior scalability, flexibility, and performance compared to traditional on-premise or cloud-hosted solutions.

The platform offers robust data integration capabilities through APIs, enabling seamless connection with various data sources and systems. This helps break down data silos and facilitates cross-functional collaboration. The architecture allows for faster release cycles and easier updates without disrupting business operations. This agility enables organizations to quickly adapt to changing requirements and leverage new features.

The solution utilizes multi-model data management to support both operational and analytic use cases, providing the flexibility to handle diverse data types and use cases. This approach allows for purpose-built services and components that can be combined to enhance customer experiences.

Pretectum CMDM’s cloud-native design enables auto-scaling capabilities to handle spikes in data volume and usage, ensuring performance and responsiveness as data grows. By offering modern capabilities, Pretectum CMDM helps organizations overcome the limitations of outdated systems, simplify complex integrations, and build a flexible, scalable foundation for future data management needs.

Breaking Down Data Silos

Pretectum’s Centralized Master Data Management (CMDM) system effectively addresses the challenge of breaking down data silos and promotes cross-departmental collaboration. The CMDM creates a centralized repository for customer master profiles, integrating data from various departments and systems across the organization. This centralization eliminates information silos by providing a single, authoritative source of customer data accessible to all relevant stakeholders. Pretectum CMDM employs a modular architecture that allows for seamless integration via API with existing software applications, databases, and third-party services.

Interoperability facilitates data flow across different departments and systems, promoting collaboration and ensuring consistent data throughout the organization. The platform implements standardized and custom data formats and structures, improving data consistency and quality across departments. Standardization streamlines reconciliation and reporting processes by ensuring all teams are working with uniform, high-quality data.

The cloud-based nature enables real-time updates and allows team members to access information from anywhere, fostering dynamic collaboration across departments and locations. This accessibility encourages cross-functional teamwork and data-driven decision-making.

By providing a unified view of customer data, Pretectum CMDM enables better-informed decision-making across the organization. This shared approach to insights promotes alignment between departments and encourages collaborative strategies based on comprehensive customer understanding.

Leveraging Automation and AI

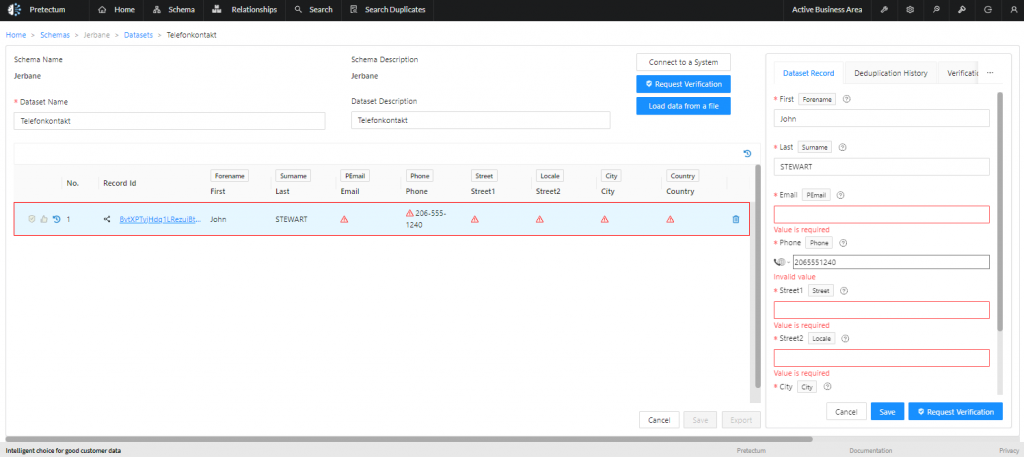

Pretectum CMDM leverages automation and AI to address resource constraints and skill gaps. The system automate routine data management tasks like data preparation at load, deduplication, and standardization.

This reduces the manual workload on finance teams and improves overall data quality. Natural language processing capabilities allow Pretectum CMDM to extract insights from the data in response to ordinary questions.

Without a knowledge of query syntax, this unlocks valuable information to users without requiring any particular skills. The platform’s intuitive interface and AI-assisted search functionality make it easier for users to find and work with data, reducing the technical skills required. This helps bridge skill gaps within finance teams.

Automation streamlines data governance processes, ensuring proper controls without overburdening staff. The system flags data issues automatically.

By handling many time-consuming data management tasks, Pretectum CMDM allows finance professionals to focus on higher-value strategic activities that leverage their domain expertise. This helps organizations maximize the impact of limited resources.

Best Practices for Data Management in Finance

To get the most out of your data management efforts in general you will want to consider implementing these best practices, many of which are natively supported for customer master data management by the Pretectum CMDM.

- Clearly identify your business goals to guide your data management strategy.

- Focus on data quality by implementing regular checks and training team members on proper data input processes.

- Set up appropriate access controls to ensure the right people can access the data they need when they need it.

- Prioritize data security by implementing robust protection measures and having a strategy in place for handling potential breaches.

- Leverage self-service portals to allow customers to manage their own account data, improving accuracy and saving time for your team.

On the horizon

The role of data management in finance will simply grow even more critical as time passes. The rapid growth in data capabilities, AI applications, and other technological advances provide CFOs with new tools to solve data issues and build more robust data architectures.

These advancements will enable finance teams to meet the growing demands placed on them more effectively. From providing real-time insights to stakeholders to enabling more accurate forecasting and risk management, the potential benefits of advanced data management in finance are immense.

However, realizing these benefits will require ongoing investment in technology, skills development, and organizational change. Finance leaders must be prepared to champion data management initiatives and foster a data-driven culture within their organizations.

While data management in finance presents numerous challenges, it also offers significant opportunities for those who can master it. By implementing robust data management strategies offered and supported by platforms like the Pretectum CMDM, and leveraging other advanced technologies, finance teams can transform data from a challenge into a powerful asset, driving business success in an increasingly data-centric world.

Contact us to learn more