Get your customer master data wrong, and you have a potentially critical risk factor in your accounting function. A risk that can significantly impact organizational efficiency, profitability, and overall success.

The challenges associated with maintaining accurate and reliable customer records are not just technical issues; they are strategic business concerns that can affect everything from customer satisfaction to cash flow.

The Importance of Customer Master Data Integrity

Customer master data encompasses all the essential information about a company’s customers, including contact details, summarized interaction history, preferences, and more.

Customer profile data is foundational for various business processes, including marketing, sales, customer service, and accounts receivable. However, maintaining the integrity of this data is a persistent challenge for many companies. According to many research, a significant percentage of companies lack proper procedures for maintaining master data, leading to inaccuracies and inefficiencies that can drain profits and cash flow.

One of the most pressing issues with customer master data is duplication. Duplicate records can arise from multiple sources, such as mergers and acquisitions, disparate data entry systems, and inconsistent data management practices. These duplications can lead to operational errors, disputes, and chargebacks, all of which increase costs and reduce cash flow.

The Risks of Data Duplication

Data duplication poses several risks to businesses, particularly when it comes to managing customer relationships and financial transactions. When customer data is duplicated across multiple accounts, it becomes challenging to obtain a clear and accurate view of a customer’s total engagement with the company. This fragmentation can result in several adverse outcomes:

Inaccurate Credit Assessments: Without a unified view of a customer, businesses may inadvertently extend more credit than is prudent, leading to increased financial risk. For example, a customer might open a new line of credit in one division while being on credit hold in another, exposing the company to potential losses.

Inefficient Collections: Fragmented customer data can hinder the efficiency of accounts receivable processes. When customer debts are spread across multiple accounts, it becomes difficult to track and collect outstanding payments, leading to delays and reduced cash flow.

Customer Dissatisfaction: Duplicate records can lead to inconsistent customer experiences. Customers may receive conflicting communications or be subjected to redundant processes, which can erode trust and satisfaction.

Regulatory Compliance Challenges: Inaccurate and incomplete customer data can lead to compliance issues, particularly in industries with stringent regulatory requirements. Incorrect data can result in fines and legal complications, further impacting the company’s bottom line.

Addressing Data Duplication with Master Data Management

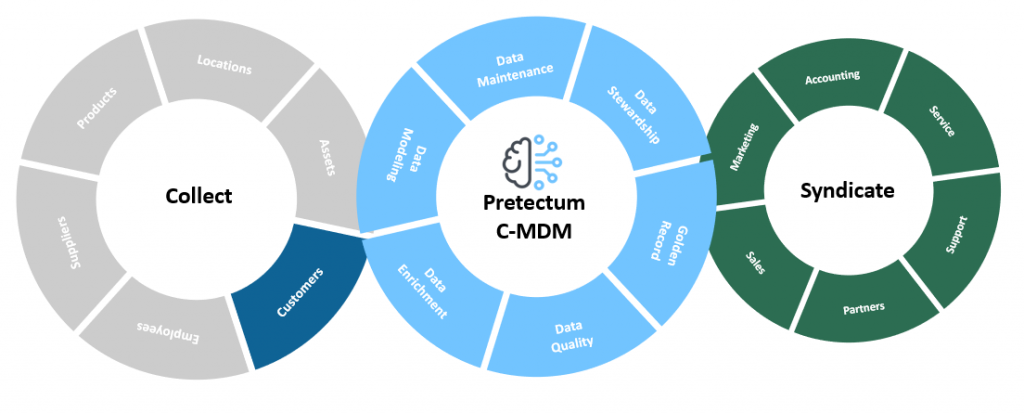

To mitigate the risks associated with data duplication, companies can implement robust master data management (MDM) strategies. Pretectum’s CMDM provides a centralized framework for managing customer data, ensuring that all customer profiles are more accurate, more complete, and consistently understood and viewed across the organization.

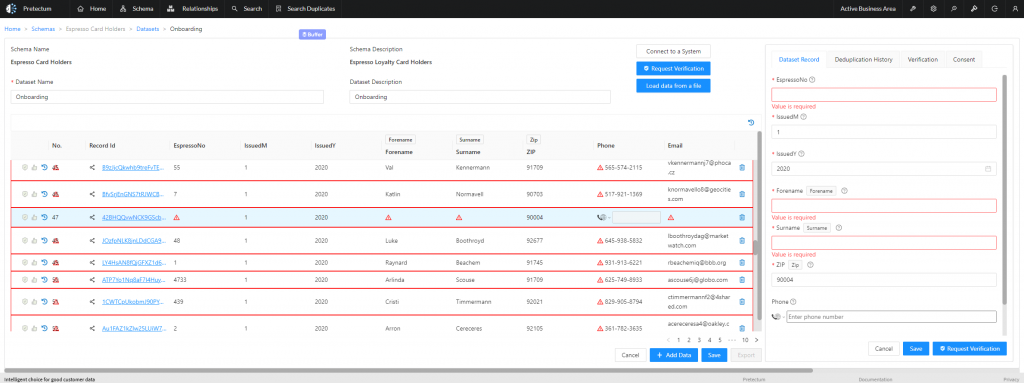

Centralized Data Repository: The Pretctum repository serves as a single source of truth for customer data, consolidating information from various sources into a unified profile. This centralization eliminates duplication and ensures that all departments have access to the same, accurate customer information.

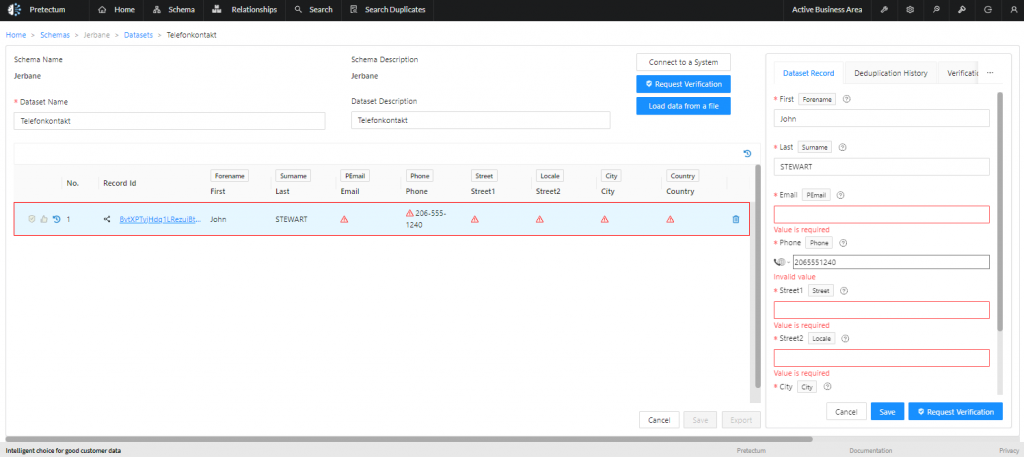

Data Validation and Cleansing: The system incorporates data validation and cleansing processes to identify and rectify errors in customer records. By regularly auditing and updating customer data, businesses can maintain high data quality and prevent the proliferation of duplicate and bad records.

Automated Data Matching: Pretectum’s automated data matching detects potential duplicates and supports merging duplicate records. This identifies similarities in customer data across different accounts and allows you to consolidate them into a single, comprehensive profile.

Improved Data Governance: The Pretectum system enhances data governance by establishing clear policies and procedures for customer data management. This governance framework ensures that customer data is managed consistently and securely, reducing the risk of unauthorized access or modifications and unnecessary data loss opportunities.

Enhancing Business Processes with CMDM

Implementing a robust Customer MDM system like the Pretectum CMDM for Customer Master Data Management not only addresses data duplication issues but also enhances business processes. By providing a clear and accurate view of customer data, the system enables your business to make better-informed decisions and optimize your operations.

Streamlined Accounts Receivable: With accurate customer data, accounts receivable teams can more effectively track and collect outstanding payments. A unified view of the customer profiles allows for better prioritization of collections efforts, improving cash flow and reducing the days sales outstanding (DSO).

Personalized Customer Interactions: Pretectum enables businesses to deliver personalized customer experiences by providing insights into customer preferences and behaviors. This personalization can enhance customer satisfaction and loyalty, driving long-term business growth.

Regulatory Compliance: By maintaining accurate and complete customer records, CMDM helps businesses comply with regulatory requirements. This compliance reduces the risk of fines and legal issues, protecting the company’s reputation and financial stability.

The integrity of customer master data is a critical component of successful business operations. Data duplication and fragmentation pose significant risks, but these challenges can be effectively addressed through robust master data management strategies.

By centralizing customer data, implementing data validation and cleansing processes, and enhancing data governance, businesses can mitigate the risks associated with data duplication and improve their overall efficiency and profitability. As companies continue to navigate the complexities of the digital age, investing in CMDM will be essential for maintaining data integrity and achieving sustainable growth.

Additional Reading: